Give

Build brighter futures with a donation to Three Rivers College. Your gifts make a difference and you decide how your gift is used. All gifts to the Three Rivers Endowment Trust are tax-deductible.

Three Rivers College provides unique ways to connect education with businesses, industry and the communities in Southeast Missouri. The Development Office coordinates fundraising activities for the College and is responsible for cultivating and maintaining strong relationships with donors.

About the Endowment Trust

The Three Rivers Endowment Trust is the 501(c)(3) not-for-profit organization designated by Three Rivers College to receive and manage gifts on behalf of the College. The Endowment Trust actively seeks contributions from a variety of sources, including individuals, businesses and corporations. It acts as a trustee for donations to ensure that gifts are distributed in the manner specified by the donor.

Ways to Give

Three Rivers College is grateful for the dedication and generosity of donors who answer the call to give. The Development Office values partnerships with those who share our commitment to preparing students for the future, and our staff stewards relationships with donors so the experience of giving to Three Rivers College is gratifying. All gifts made to Three Rivers Endowment Trust are tax deductible.

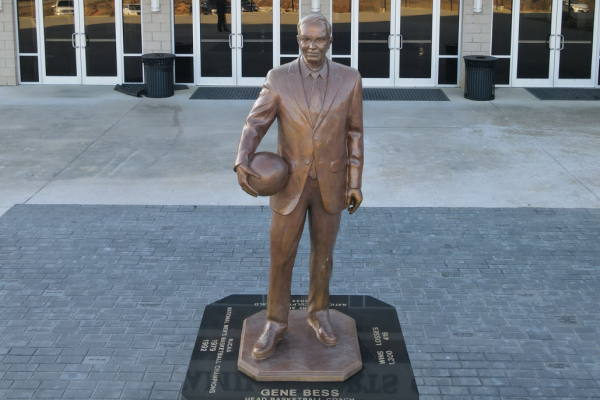

Buy a Brick at the Libla Family Sports Complex

Be part of the Brick Walk around the Gene Bess statue at the Libla Family Sports Complex.

$19.66 Campaign

Three Rivers College was founded in 1966, and giving $19.66 as a one-time or recurring donation will help the next generation of students succeed.

Scholarships

The need for scholarships continually grows with more than 60% of all Three Rivers students receiving some kind of financial aid.

Buy a Book

Make a gift to the Myrtle Rutland Library to help keep our collection current.

Host a Fundraiser

Host an event to raise funds for scholarships or College-related causes.

Memorial Fund

Honor the memory of your loved on with a memorial fund benefiting Three Rivers and its students.

Upcoming Endowment Trust Events

More Ways to Give:

- Cash

- Securities (stocks, bonds, notes)

- Life insurance

- Real estate, personal property or equipment

- Pledges, bequests by will

- Trusts with tax benefits to the donor

- Leases (often given by way of charitable remainder trusts)

Planned Giving

Leave a legacy gift to Three Rivers College to benefit you and your family, as well as our students, faculty and programs.

Gift Fee FAQs

Get answers to frequently asked questions about the Three Rivers Endowment Trust’s gift fees.

What is the Three Rivers Endowment Trust’s gift fee?

Each donation to the Three Rivers Endowment Trust is assessed a 4% one-time administrative fee. Endowed scholarships are excluded from the gift fees.

Gift fee revenue is directly related to the Endowment Trust’s cost of doing business. Effective fundraising requires the deployment of financial resources to cover direct costs of soliciting, processing and accounting for donated funds. As gifts to benefit Three Rivers College increase, the costs of gift receipting, accounting, and investing/disbursing funds increase. Additionally, the gift fee allows the Endowment Trust to reduce its reliance on direct funding for its operations from Three Rivers College, thus freeing College funds for education.

Do other colleges and universities charge gift fees?

Yes, a gift fee of 3-6% is not uncommon at higher education foundations throughout the country. The University of Missouri currently charges a 3% fee. We are a relatively young organization with a comparatively small endowment, and thus endowment management fees only partially cover our costs of doing business. However, even older organizations with much larger endowments frequently charge gift fees.

The local non-profit organizations I support don’t charge gift fees. What’s the difference?

The difference is primarily one of terminology. All community organizations have operating costs. In general, revenue from contributions helps in part to support them, whether or not a formal gift fee is identified. United Way, for example, typically charges fees of 15% or more. In the non-profit sector, best practice standards hold that operating costs in the range of 15-20% are considered to be excellent, assuring that approximately $0.80 of every dollar contributed goes to providing direct services. By comparison, $0.96 of each dollar you give to the Three Rivers Endowment Trust gets put to work by Three Rivers College for the specific purpose you choose to support.

How often does the gift fee change?

The Three Rivers Endowment Trust’s funding sources are recommended by our Finance Committee and approved by our Board. The Finance Committee reviews the gift fee on an annual basis. In order to assure budgetary and financial stability, it is changed only rarely.

Does the Three Rivers Endowment Trust charge other fees?

Like the vast majority of other foundations and trusts, the Three Rivers Endowment Trust realizes an annual fee to manage endowed funds that are invested in perpetuity by our investment agency. Because we want to maximize our endowment’s growth over time, we keep this annual management fee to a minimum, currently 1.15% of the market value of the endowment.